Schaeffler Group improves profitability in 2023

2024-03-05 | Belrose

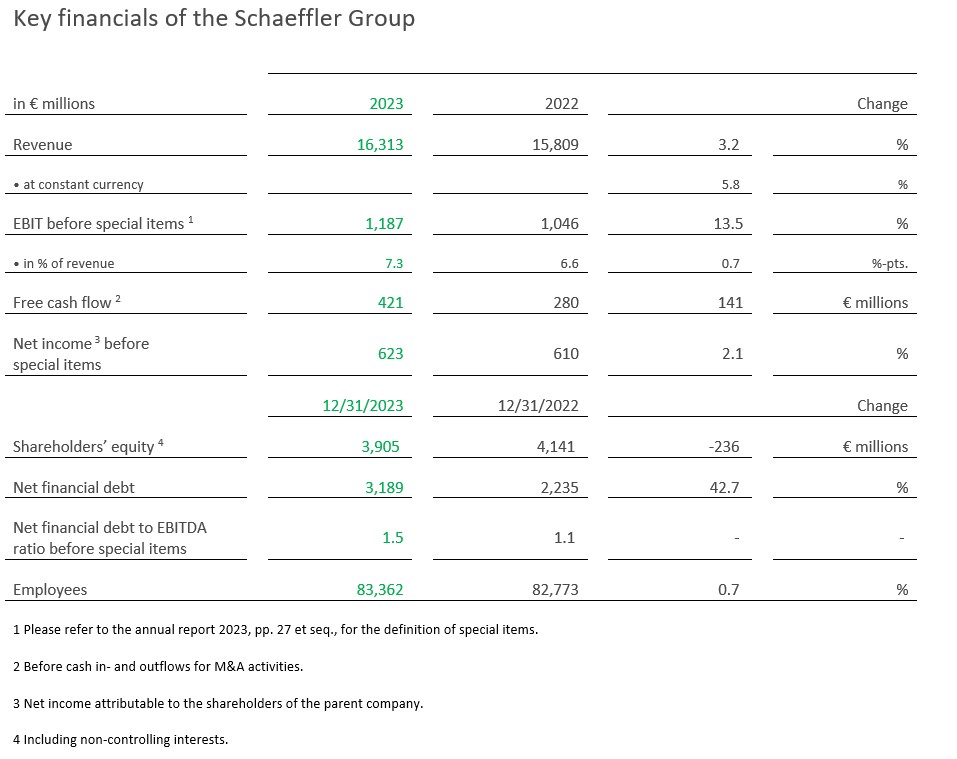

- Schaeffler Group revenue up 5.8 percent at constant currency to 16.3 billion euros (prior year: 15.8 billion euros)

- EBIT before special items improved to 1,187 million euros (prior year: 1,046 million euros), EBIT margin before special items at 7.3 percent (prior year: 6.6 percent)

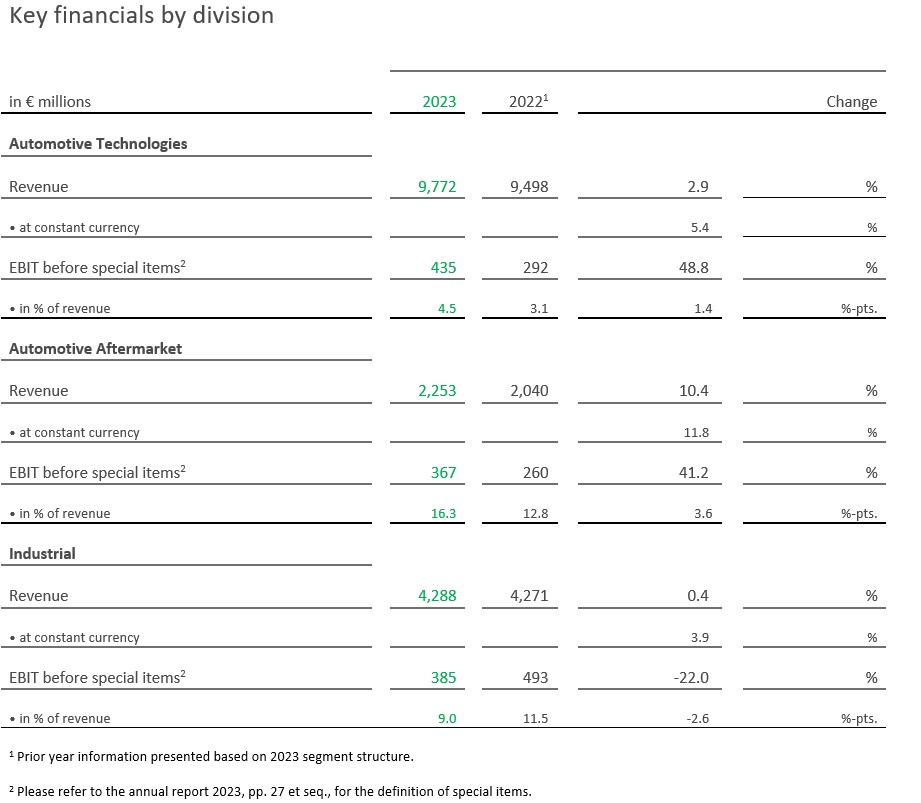

- Automotive Technologies considerably improves EBIT margin before special items, Automotive Aftermarket reports strong revenue growth, and Industrial reports market-related decline in margins

- Free cash flow before cash in- and outflows for M&A activities of 421 million euros better than guidance despite increased investing activities

- Proposed dividend of 0.45 euros per common non-voting share

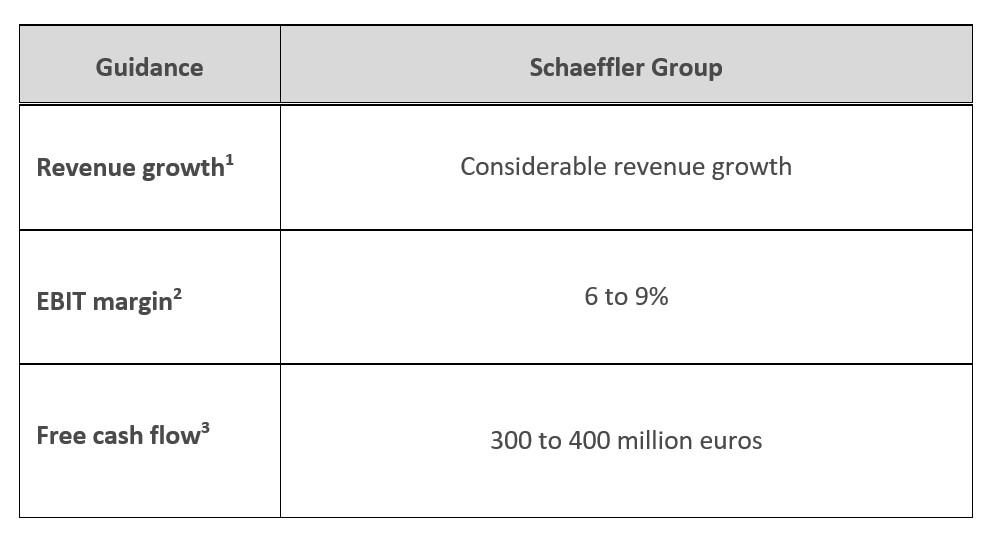

- Guidance reflects planned merger with Vitesco Technologies

Schaeffler AG published its results for 2023 today. The Schaeffler Group’s revenue for the year amounted to 16.3 billion euros (prior year: 15.8 billion euros). Revenue grew by 5.8 percent at constant currency, in line with the guidance for 2023 [revenue growth of 5 to 8 percent]. The constant-currency increase in revenue in 2023 is mainly attributable to increased volumes. Sales prices had an additional favorable impact on revenue.

In 2023 the Schaeffler Group generated earnings before financial result and income taxes (EBIT) of 834 million euros (prior year 974 million euros), a figure that was influenced by 353 million euros in special items. EBIT before special items amounted to 1,187 million euros (prior year: 1,046 million euros). The group’s EBIT margin before special items of 7.3 percent (prior year: 6.6 percent) solidly met the guidance for 2023 [EBIT margin before special items of 6 to 8 percent], despite the challenging market environment. The increase in EBIT margin before special items was mainly due to the favorable impact of volumes and sales prices.

The Schaeffler Group’s free cash flow before cash in- and outflows for M&A activities totaled 421 million euros in 2023 (prior year: 280 million euros), exceeding the full-year guidance [free cash flow before cash in- and outflows for M&A activities of 300 to 400 million euros]. Net income attributable to shareholders of the parent company amounted to 310 million euros in 2023 (prior year: 557 million euros). The decline in net income was mainly influenced by 313 million euros in special items, which were primarily attributable to the transaction with Vitesco Technologies Group AG announced on October 9, 2023. Net income before special items amounted to 623 million euros (prior year: 610 million euros). Based on net income attributable to the shareholders of the parent company and without the adjustments above, earnings per common non-voting share were 0.47 euros (prior year: 0.84 euros).

At the extraordinary general meeting on February 2, 2024, Schaeffler announced that a dividend payment of 0.45 euros per common non-voting share will be proposed to the annual general meeting on this basis (prior year: 0.45 euros). This represents a dividend payout ratio of approximately 47.3 percent (prior year: 48.3 percent) of net income attributable to shareholders before special items. The company also announced that the dividend payout ratio will be raised from previously 30 to 50 percent of net income attributable to shareholders before special items to 40 to 60 percent going forward.

“During the past financial year, the Schaeffler Group generated good results and continued to consistently pursue its transformation based on its Roadmap 2025,” says Klaus Rosenfeld, CEO of Schaeffler AG. “In a challenging market environment, our diversified positioning proved to be a competitive advantage once again. We will propose an attractive dividend of 45 cents to the annual general meeting in order to share the company’s success with our shareholders.”

Automotive Technologies – EBIT margin before special items improved considerably

The Automotive Technologies division generated revenue of 9,772 million euros in 2023 (prior year: 9,498 million euros). The constant-currency growth of 5.4 percent year on year resulted primarily from a market-driven increase in volumes.

In the E-Mobility business division (BD), revenue was in line with the prior year’s level at constant currency, while order intake of 5.1 billion euros was once again considerably above the targeted range of 2 to 3 billion euros per year. The constant-currency increase in revenue in the Engine & Transmission Systems and Bearings BDs was largely driven by growth in the Europe region and amounted to 5.3 percent and 5.6 percent compared to the prior year. At 24.1 percent, the Chassis Systems BD reported the strongest constant-currency growth rate. The main drivers here were the Europe and Greater China regions.

The Europe region grew the most, recording an increase in revenue of 12.4 percent at constant currency. While the Americas region reported a constant-currency decline of 2.8 percent, revenue in the Greater China and Asia/Pacific regions rose by 2.0 and 7.3 percent at constant currency. The overall increase in the division’s revenue was less than the growth rate of global automobile production.

EBIT before special items in the Automotive Technologies division amounted to 435 million euros in 2023 (prior year: 292 million euros), representing a considerable increase of approximately 49 percent and an EBIT margin before special items of 4.5 percent (prior year: 3.1 percent). The marked increase in the EBIT margin before special items in 2023 was mainly due to the impact of volumes.

Automotive Aftermarket – strong growth, strong margin

The Automotive Aftermarket division reported revenue of 2,253 million euros in 2023 (prior year: 2,040 million euros). The considerable constant-currency increase in revenue of 11.8 percent was due to the favorable impact of volumes and sales prices. Increased procurement costs were passed on to the market.

In the Europe region, which generates the highest revenue, the Automotive Aftermarket division reported constant-currency growth of 10.3 percent, driven primarily by the considerable increase at the Independent Aftermarket business in Central & Eastern Europe. Revenue in the Americas region rose by 12.0 percent at constant currency in 2023. At 28.7 percent at constant currency, the Greater China region reported the strongest revenue growth in 2023, primarily driven by the considerable increase in e-commerce business. In Asia/Pacific, revenue was 11.8 percent higher at constant currency in 2023 than in the prior year. At 367 million euros, EBIT before special items was 41.2 percent higher than the prior-year figure of 260 million euros. The resulting EBIT margin before special items of 16.3 percent (prior year: 12.8 percent) exceeded the guidance. The continued growth was predominantly the result of a higher gross margin due to a favorable revenue mix and adjustments to sales prices.

Industrial – market-related decline in margin

The Industrial division increased its revenue by 3.9 percent at constant currency to 4,288 million euros in 2023 (prior year: 4,271 million euros). The constant-currency growth in revenue resulted from the positive contribution of the Ewellix Group, acquired early in the year, which amounted to 219 million euros and was reflected in the Industrial Automation sector cluster. The decline in the remaining sales volumes, primarily due to the weak market environment in the Greater China region, was only partly offset by a favorable impact of sales prices.

The Europe region reported a constant-currency increase in revenue of 7.0 percent. In the Americas region, revenue rose by 11.3 percent at constant currency. In the Greater China region, the weak market environment had a considerable adverse impact on the revenue trend. Revenue in this region was down 6.3 percent year on year at constant currency, while revenue in the Asia/Pacific region increased by 5.3 percent at constant currency.

EBIT before special items amounted to 385 million euros in 2023 (prior year: 493 million euros), with an EBIT margin before special items of 9.0 percent (prior year: 11.5 percent). Factors influencing earnings included a decline in gross margin as a result of a change in the revenue mix, primarily due to the market trend in the Greater China region and the market-driven overall decline in production volume.

Free cash flow – better than expected despite increased investing activities

Free cash flow before cash in- and outflows for M&A activities amounted to 421 million euros in 2023 (prior year: 280 million euros). The year-on-year increase is primarily attributable to working capital expanding less extensively than in the prior year, despite higher capital expenditures on intangible assets and property, plant and equipment.

Capital expenditures on intangible assets and property, plant and equipment (capex) rose to 938 million euros during the same period (prior year: 791 million euros), representing a capex ratio of 5.7 percent (prior year: 5.0 percent). The reinvestment rate amounted to 1.00 (prior year: 0.88).

As at December 31, 2023, the Schaeffler Group’s net financial debt amounted to 3,189 million euros (December 31, 2022: 2,235 million euros). The ratio of net financial debt to shareholders’ equity (gearing ratio) increased to 81.7 percent (December 31, 2022: 54.0 percent).

The Schaeffler Group’s total assets amounted to 15,006 million euros as at December 31, 2023 (December 31, 2022: 14,284 million euros). As at that date, the number of employees was 83,362, 0.7 percent more than the prior year figure of 82,773.

“Schaeffler achieved its targets in 2023 and once again demonstrated its financial and operational strength with a free cash flow before cash in- and outflows for M&A activities of 421 million euros,” Claus Bauer, Chief Financial Officer of Schaeffler AG, states. “In a dynamic environment, we are succeeding in expanding our competitive position in the right places by making targeted investments in new technologies.”

Guidance for 2024 reflects planned merger – considerable revenue growth expected

For 2024, the Schaeffler Group expects to account for the 38.87 percent of the shares in Vitesco Technologies acquired in January 2024 using the equity method from the date of acquisition up to and including the third quarter of 2024. Furthermore, it is anticipated that the merger with Vitesco Technologies will be entered in the commercial register in the fourth quarter of 2024 and that Vitesco Technologies will be fully consolidated in Schaeffler’s consolidated financial statements upon this registration.

Based on this, the Schaeffler Group is forecasting considerable revenue growth at constant currency in 2024. At the same time, the company expects to achieve an EBIT margin before special items of 6 to 9 percent, and anticipates free cash flow before cash in- and outflows for M&A activities of 300 to 400 million euros.

A voluntary outlook on the performance of the divisions is omitted in light of factors such as the planned structural adjustments in connection with the merger of Vitesco Technologies into Schaeffler.

1 Constant-currency revenue growth compared to prior year

2 Before special items

3 Before cash in- and outflows for M&A activities

Planned merger Schaeffler and Vitesco Technologies – leading Motion Technology Company

The planned merger with Vitesco Technologies Group AG announced by Schaeffler AG in 2023 marks a further pivotal step along its path toward becoming a leading Motion Technology Company. The transaction is expected to be completed in the fourth quarter of 2024. The integration of Vitesco Technologies will substantially broaden and expand the Schaeffler Group’s business and technology portfolio, particularly in the field of electric mobility. The Bearings business division, previously part of the Automotive Technologies division, is already being combined with the Industrial division in the first quarter of 2024. Following the merger with Vitesco Technologies, the Schaeffler Group will have four focused “pure-play” divisions, each holding a strong position in their respective markets: E-Mobility, Powertrain & Chassis, Vehicle Lifetime Solutions, and Bearings & Industrial Solutions. The regional structure with its four regions will remain.

Schaeffler AG’s public tender offer to the shareholders of Vitesco Technologies Group AG was successfully completed at the beginning of 2024. Together with IHO Holding, the Schaeffler family’s holding company, Schaeffler AG currently controls approximately 89 percent of the share capital and voting rights in Vitesco Technologies Group AG. In addition, Schaeffler’s shareholders almost unanimously approved the proposed conversion of the common non-voting shares into common shares with full voting rights at the extraordinary general meeting of Schaeffler AG and the separate meeting of the common non-voting shareholders in early February 2024. The share conversion is conditional on the merger becoming effective either previously or simultaneously. Going forward, Schaeffler AG will then have only one class of shares and all shareholders will have equal voting rights.

The merger of Vitesco Technologies into Schaeffler, the third step of the overall transaction, now requires the approval of the annual general meetings of both companies in particular, which will take place on April 24, 2024, (Vitesco Technologies) and April 25, 2024 (Schaeffler). An integration committee consisting of an equal number of members from each company was set up in December 2023 to promote rapid integration and achieve the planned revenue and cost synergies of 600 million euros a year as soon as possible. The committee meets weekly and receives operational support from central integration teams that coordinate the integration activities for both companies.

Klaus Rosenfeld, CEO of Schaeffler AG, explains: “The merger of Schaeffler and Vitesco Technologies brings significant benefits for our stakeholders. We are convinced that the transformation will make Schaeffler shares more attractive. The positive signals from the capital markets in response to the planned merger confirm that we are on the right track with our intent to create a leading Motion Technology Company.”

You can find press photos of the Board of Managing Directors here:

www.schaeffler.com/en/executive-board

Forward-looking statements and projections

The Schaeffler Group has been driving forward groundbreaking inventions and developments in the field of motion technology for over 75 years. With innovative technologies, products, and services for electric mobility, CO₂-efficient drives, chassis solutions, Industry 4.0, digitalization, and renewable energies, the company is a reliable partner for making motion more efficient, intelligent, and sustainable – over the entire life cycle. The Motion Technology Company manufactures high-precision components and systems for drive train and chassis applications as well as rolling and plain bearing solutions for a large number of industrial applications. The Schaeffler Group generated sales of EUR 16.3 billion in 2023. With around 83,400 employees, the Schaeffler Group is one of the world’s largest family-owned companies. With more than 1,250 patent applications in 2022, Schaeffler is Germany’s fourth most innovative company according to the DPMA (German Patent and Trademark Office).

Publisher: Schaeffler Australia Pty Ltd

Country: Australia

Terms of use for Schaeffler press pictures

Schaeffler press pictures may only be used for editorial purposes. Unless otherwise stated, all copyrights and rights of use and exploitation are owned by Schaeffler Technologies AG & Co. KG, Herzogenaurach (Germany) or by one of its affiliated companies. The reproduction and publication of Schaeffler press pictures is only permitted if the source is stated as follows: "Image: Schaeffler". The pictures may be used free of charge in such cases. The use of pictures for advertising or other commercial purposes, in particular their disclosure to third parties for commercial purposes, is hereby prohibited. Pictures may only be edited with the approval of Schaeffler.

We kindly request that a specimen copy be sent to us when Schaeffler press pictures are published in printed media (or a digital copy in the case of publication in electronic media). When using Schaeffler press pictures in films, please notify us and state the title of the film.

Use and utilization of Schaeffler press pictures is subject to the substantive laws of Germany without its conflict of law provisions. The place of competent jurisdiction shall be Nuremberg, Germany.

Postal address:

Schaeffler Technologies AG & Co. KG

Corporate Communication

Industriestrasse 1-3

91074 Herzogenaurach

Germany

Press releases

Package (Press release + media)